How I Structured My Startup’s Equity to Protect Everyone’s Future

You’ve got a great idea, a solid team, and momentum building—so why do so many startups crash when equity gets messy? I learned the hard way when early promises backfired, nearly costing me everything. Turns out, equity isn’t just about giving shares—it’s about smart asset allocation from day one. This is how I redesigned our equity strategy to balance motivation, fairness, and long-term protection, turning potential conflict into sustainable growth. What began as a hopeful gesture—rewarding loyalty with ownership—quickly turned into a financial liability. The lesson? Equity is not a gift. It’s a strategic decision with lasting consequences, one that shapes not only company culture but also personal financial security.

The Equity Trap No One Warns You About

At the beginning, everything feels urgent. You need talent, commitment, and trust. Offering equity seems like the perfect solution—no cash outlay, high motivation, and shared vision. But too often, founders fall into what experts call the “equity trap”: distributing ownership too early, too freely, or without clear conditions. This creates silent risks that don’t surface until it’s too late. Over-dilution is one of the most common outcomes. When too much equity is given away in the early stages, founders lose control, and future investors see the company as unstable or poorly managed. Even more dangerous is misaligned incentives. If a co-founder or early employee holds a large stake but contributes little over time, resentment builds, and performance suffers. These aren’t just interpersonal issues—they are financial liabilities that erode company value.

Consider the story of a tech startup in Austin that gave equal 33% stakes to three co-founders without vesting agreements. One left after eight months. Legally, he still owned a third of the company. The remaining two had to either buy him out at a high cost or watch their own shares—and future funding potential—diminished. This is not an isolated case. Studies show that nearly 60% of founder disputes involve unclear equity terms. The emotional appeal of rewarding loyalty often overrides rational financial planning. Founders say, “I want to be fair,” but fairness without structure leads to imbalance. Equity should reflect not just initial contribution but sustained effort, risk taken, and long-term value creation. Without mechanisms like vesting or performance clauses, equity becomes a liability rather than an asset.

Treating equity as part of your overall financial strategy changes everything. Instead of viewing it as a cost-free incentive, think of it as a finite resource—like cash or inventory. Every share you give away reduces your future flexibility. It affects your ability to raise capital, attract talent later, and maintain control during critical decisions. The key is to shift mindset: from generosity to stewardship. You are not just building a company; you are managing a portfolio of value that must last beyond the startup phase. This means setting clear rules from day one, even when relationships feel strong. It means delaying emotional decisions until legal and financial frameworks are in place. Because once equity is granted, it’s incredibly difficult to take back. The earlier you structure it wisely, the more protected everyone’s future becomes.

Equity as a Strategic Asset, Not Just a Bonus

Many founders treat equity like a bonus—an extra perk to sweeten a job offer or seal a partnership. But this mindset undermines its true value. Equity is not an expense; it’s an investment in the company’s future, and how you allocate it directly impacts financial health. When used strategically, equity can align interests, preserve cash, and enhance valuation. When misused, it can cripple growth and scare away investors. The difference lies in understanding equity as a core component of your capital structure, not just a motivational tool.

Take cash flow, for example. Startups often operate on tight budgets. Offering equity instead of salary can help conserve cash, allowing funds to be used for product development or marketing. But this only works if the equity distribution is sustainable. Giving away 40% of the company in the first year may keep salaries low, but it leaves little room for future hires or investors. A better approach is to reserve equity for high-impact roles—founders, key executives, and critical early hires—while using smaller grants for support roles. This ensures that ownership remains concentrated where it matters most.

Valuation is another critical factor. Investors don’t just look at revenue or user growth; they examine ownership structure. A clean cap table—meaning a clear, logical distribution of shares—signals professionalism and reduces perceived risk. In contrast, a messy cap table with too many small shareholders or unclear vesting terms raises red flags. It suggests poor governance and increases the complexity of future funding rounds. Smart equity allocation helps maintain a strong valuation by showing that the company has thought ahead about ownership and control.

Moreover, equity affects investor appeal. Venture capitalists and angel investors want to see that founders have “skin in the game.” If the founding team holds a strong majority, it shows commitment. If ownership is too diluted, investors may question whether founders will stay motivated after a funding round. They also look for option pools—reserves of equity set aside for future employees. A typical early-stage startup sets aside 10% to 15% for this purpose. Without it, investors may demand a larger share for themselves, further diluting the founders. By treating equity as a strategic asset, you position the company as investor-ready from the start.

Designing a Balanced Equity Framework

So what does a healthy equity structure actually look like? There’s no one-size-fits-all answer, but successful startups tend to follow a few common principles. First, ownership should reflect contribution, risk, and timeline. Founders who take the biggest risks—leaving stable jobs, investing personal savings—typically receive the largest shares. Early employees who join before product launch take on more uncertainty and deserve meaningful stakes. Later hires, while valuable, usually receive smaller grants. This tiered approach ensures fairness while preserving long-term flexibility.

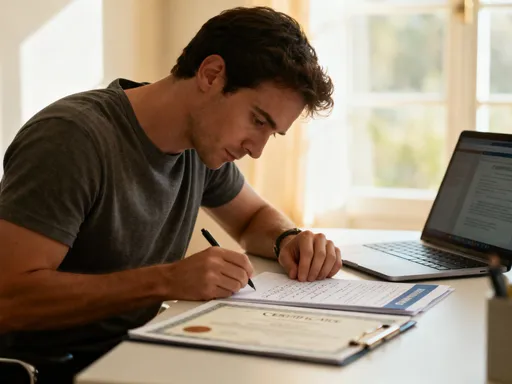

Vesting schedules are a cornerstone of balanced equity. A standard four-year vesting period with a one-year cliff means that shares are earned over time, not granted upfront. If someone leaves before the first year, they get nothing. After one year, they receive 25% of their promised equity, with the rest vesting monthly or quarterly. This protects the company from losing value to short-term contributors. It also encourages retention, as employees have a financial incentive to stay. Vesting applies not just to employees but to founders as well. Even co-founders should sign vesting agreements—this prevents a departing founder from holding onto a large stake without continuing to contribute.

Founder agreements are equally important. These legal documents outline each founder’s role, responsibilities, and ownership stake. They also include provisions for what happens if a founder leaves, becomes incapacitated, or fails to perform. Without such agreements, disputes can escalate quickly, especially as the company grows. A well-drafted agreement includes buy-sell clauses, dispute resolution mechanisms, and clear definitions of equity ownership. It’s not about mistrust—it’s about clarity. Just as a prenuptial agreement protects both partners in a marriage, a founder agreement protects the company and its leaders.

Option pools are another essential tool. Setting aside 10% to 15% of equity for future hires allows the company to attract talent without constant renegotiation. It also gives investors confidence that the company plans to grow its team. The timing of when to create the option pool matters. Ideally, it should be established before the first major funding round, so that early dilution is absorbed by the founders, not future investors. This shows foresight and strengthens negotiation power. Together, vesting schedules, founder agreements, and option pools form a financial framework that protects value, aligns incentives, and supports sustainable growth.

Aligning Incentives Without Giving Away the Farm

Motivating key players is essential, but you don’t have to sacrifice control to do it. The secret lies in conditional equity grants—shares that are earned based on performance, milestones, or time. This approach allows you to promise meaningful rewards without immediately transferring ownership. For example, instead of granting 5% equity to a new CTO on day one, you might offer 2% upfront with an additional 3% tied to specific achievements: launching a product, hitting user milestones, or securing patents. This keeps the team focused on results, not just tenure.

Performance triggers are powerful because they link equity to value creation. If a marketing lead increases customer acquisition by 200% in six months, they earn a bonus in shares. If a product manager delivers a feature on time and within budget, they unlock a portion of their equity. These triggers should be measurable, realistic, and aligned with company goals. They turn equity from a fixed cost into a variable reward—one that only pays out when the company benefits. This protects the founder’s stake and ensures that every share granted corresponds to real progress.

Milestone-based releases work similarly. Rather than vesting shares evenly over four years, you can structure the schedule around key company events: closing seed funding, launching an MVP, reaching $1 million in revenue, or expanding into a new market. This ties personal rewards to company success, reinforcing a culture of accountability. It also helps manage dilution. If a milestone isn’t met, the equity isn’t released—preserving ownership for future needs. This is especially useful in early stages when outcomes are uncertain.

Another strategy is to use different classes of shares. Founders can hold shares with full voting rights, while employees receive non-voting or restricted shares. This allows you to share in financial upside without giving up decision-making power. It’s a common practice in growing companies and reassures investors that the founding team remains in control. The goal is not to withhold equity, but to distribute it wisely—ensuring that motivation is high, but ownership remains sustainable. When done right, this balance fuels growth without risking the foundation.

Protecting Value Through Diversification

Founders often make a critical financial mistake: they concentrate too much of their personal wealth in their company’s equity. While passion and commitment are admirable, putting all your financial eggs in one basket is risky. If the startup fails, not only do you lose your job, but your net worth can collapse overnight. This is why smart founders treat their personal finances separately from their company’s success. They apply the same principle of diversification used in investment portfolios—spreading risk across different assets—to their own financial planning.

Diversification doesn’t mean losing faith in your company. It means protecting your family’s future. Imagine a founder who owns 60% of a startup valued at $2 million. On paper, they’re worth $1.2 million. But that value is illiquid—it can’t be accessed without selling shares, which may not be possible for years. If they also have most of their savings tied up in the business, a downturn could leave them financially vulnerable. A better approach is to maintain a personal portfolio of stocks, bonds, real estate, or other businesses. This provides financial stability, even during tough times.

Some founders set up side income streams—a consulting practice, rental property, or a small investment fund. These not only generate cash flow but also reduce emotional pressure to take excessive risks with the startup. When you’re not dependent on one source of income, you can make calmer, more strategic decisions. You’re less likely to accept a bad term sheet just to keep the lights on. You’re more willing to pivot, iterate, or even walk away if needed.

Another strategy is to gradually liquidate small portions of equity during funding rounds. When investors buy shares, founders can sell a percentage of their stake to lock in gains. This is not about cashing out completely—it’s about reducing exposure. For example, selling 10% of your shares in a Series A round allows you to pay off debt, fund education, or build an emergency fund. It’s a way to harvest value while still maintaining control and upside potential. The key is to plan this in advance, not react in crisis. By integrating personal financial health with company equity, founders create a safety net that supports long-term resilience.

Navigating Investor Expectations and Term Sheets

When investors come in, your equity structure becomes a focal point of negotiation. A clean, well-documented cap table gives you credibility and leverage. It shows that you’ve thought seriously about ownership, risk, and growth. On the other hand, a disorganized or overly diluted cap table can scare off even the most interested backers. Investors want to see that founders are in control, that key team members are properly incentivized, and that there’s room for future hiring and funding.

Term sheets—the preliminary agreements outlining investment terms—often include clauses that directly affect equity. Anti-dilution provisions, liquidation preferences, and option pool adjustments can significantly alter ownership after funding. If your equity wasn’t structured properly beforehand, these clauses can erode your stake faster than expected. For example, a large option pool created after investment means existing shareholders, including founders, get diluted. If it had been created before, the dilution would have been absorbed earlier, protecting future rounds.

Smart pre-investment planning helps you negotiate from strength. By setting up vesting, defining founder roles, and reserving an option pool early, you reduce uncertainty. Investors appreciate transparency and are more likely to offer favorable terms. They know the company won’t face internal disputes over ownership later. They also trust that equity is being used strategically, not emotionally. This can lead to higher valuations and better deal terms.

It’s also important to understand how different types of investors view equity. Angel investors may be more flexible, focusing on potential and team. Venture capitalists, however, run institutional funds and must deliver returns to their limited partners. They scrutinize cap tables closely and prefer startups with clear, scalable ownership models. By aligning your equity structure with investor expectations, you increase your chances of securing funding on favorable terms. The goal isn’t to please investors—it’s to build a company that can grow sustainably, with or without outside money.

From Survival to Sustainability: Building a Legacy

The final evolution in equity thinking is shifting from survival to sustainability. Early on, equity is about keeping the company alive—motivating the team, conserving cash, and attracting early support. But as the company grows, equity should serve a broader purpose: building long-term wealth and legacy. This means re-evaluating your model at every stage, ensuring it continues to support both business goals and personal financial health.

As revenue increases and funding rounds close, revisit your equity distribution. Are early promises still fair? Are key contributors being rewarded appropriately? Is the cap table clean enough to support an IPO or acquisition? These questions require ongoing attention. Some founders choose to refresh option pools, adjust vesting terms, or introduce profit-sharing plans. Others create family trusts or estate plans that include company shares, ensuring wealth transfer across generations. The goal is to make equity a tool for lasting impact, not just short-term gain.

Ultimately, a well-structured equity plan does more than prevent conflict—it builds trust. It shows employees that their contributions matter, investors that the company is well-managed, and family members that the founder is thinking responsibly. It turns a potential source of tension into a foundation for stability. And when the company succeeds, the rewards are shared fairly, based on real value created.

Equity is more than a legal document. It’s a promise—a promise of fairness, commitment, and shared future. When structured wisely, it protects not just the company, but everyone who believes in it. That’s not just smart finance. It’s leadership.