Passing Down More Than Wealth: Building Investment Portfolios That Last Generations

Inheritance isn’t just about money—it’s about values, legacy, and the future we shape for those who come after us. I used to think preserving wealth was only about returns, but I’ve learned it’s more about resilience, alignment, and intention. What if your portfolio could reflect not just financial strategy, but cultural identity and family purpose? This is where smart investing meets meaningful传承. Let’s explore how to build portfolios that endure, ensuring that when the time comes, what you pass down isn’t just assets—but principles, memories, and a roadmap for the generations ahead. It’s not merely about leaving something behind; it’s about building something forward.

The Hidden Purpose Behind Wealth Transfer

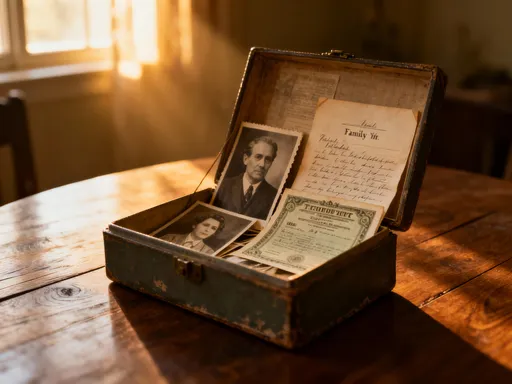

Wealth transfer is often discussed in terms of net worth, tax efficiency, and legal structures. These are important, no doubt, but they represent only part of the picture. Beneath the numbers lies a deeper current—family identity. For many, especially those raising children with strong cultural roots or ethical beliefs, the idea of inheritance extends beyond financial security. It becomes a way to preserve stories, traditions, and shared values that might otherwise fade with time. Consider a family that immigrated decades ago, built a business from scratch, and now seeks to pass on not just the proceeds, but the work ethic, frugality, and sense of community that made success possible. Their portfolio can be designed to reflect those ideals—investing in education funds, supporting local initiatives, or allocating capital to enterprises that mirror their journey.

Yet too often, families focus exclusively on asset size, leaving the emotional and cultural dimensions unaddressed. The result? Heirs may inherit wealth without understanding its origin or purpose, leading to disconnection, mismanagement, or even conflict. Research shows that nearly 70% of wealthy families lose their fortune by the second generation, and 90% by the third. While poor financial planning contributes to this trend, the deeper cause is frequently a lack of shared vision. When wealth is transferred without context, it becomes a burden rather than a blessing. The solution lies in redefining inheritance as a holistic process—one that weaves financial strength with moral clarity and intergenerational dialogue.

This shift begins with asking the right questions: What does prosperity mean to our family? What values should guide how we grow and use our resources? How can investments support not just consumption, but contribution? Answering these requires more than spreadsheets; it demands conversations—across generations, around dining tables, during family gatherings. These moments of reflection help align investment decisions with a broader sense of purpose. For instance, a family that values environmental stewardship might choose to exclude fossil fuel companies from their holdings, while one committed to education might prioritize funding scholarships or investing in ed-tech ventures. In this way, portfolios become more than balance sheets—they become statements of belief.

Investment Portfolios as Living Legacies

A truly enduring portfolio is not static. It evolves, adapts, and responds to changing family needs and global conditions. Think of it not as a vault of locked assets, but as a living garden—planted with care, nurtured over time, and harvested thoughtfully. This metaphor captures the essence of a legacy-ready investment strategy: one that balances growth with preservation, innovation with tradition, and individual goals with collective well-being. Such portfolios are built not for a single generation, but for many, with structures that allow for flexibility as family dynamics shift—children grow, new spouses join, grandchildren emerge, and priorities evolve.

What makes a portfolio “legacy-ready”? First, it must be diversified—not only across asset classes like stocks, bonds, real estate, and alternatives, but also across purposes. Some portions may be dedicated to income generation, others to long-term appreciation, and still others to philanthropy or cultural preservation. For example, a portion of the portfolio might be allocated to community development financial institutions (CDFIs) that support small businesses in the family’s ancestral region. Another segment could fund language immersion programs for younger relatives, helping them stay connected to their heritage. These allocations do more than generate returns—they reinforce identity and continuity.

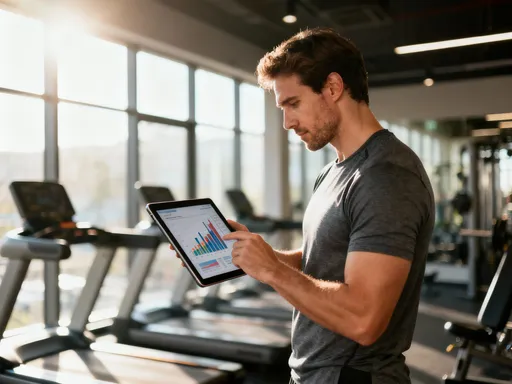

Second, a legacy portfolio must be transparent and understandable. Complexity is the enemy of stewardship. If heirs cannot grasp how the portfolio works, they are less likely to manage it wisely. That’s why clarity in structure and communication matters. Using straightforward investment vehicles—such as low-cost index funds, dividend-paying blue-chip stocks, or real estate investment trusts (REITs)—can make ownership more accessible. At the same time, documentation such as family mission statements, investment guidelines, and educational materials can help bridge knowledge gaps. The goal is not to hand over a mystery, but to pass on a system—one that invites participation and responsibility.

Finally, a living legacy portfolio embraces adaptability. Market conditions change. So do laws, tax codes, and family circumstances. A rigid plan may fail when tested by real life. Instead, the portfolio should include mechanisms for periodic review and adjustment—perhaps through an annual family meeting or a trusted advisory board. This ensures that while core values remain constant, strategies can shift as needed. In this way, the portfolio becomes a dynamic expression of heritage, capable of weathering change while staying true to its roots.

Balancing Return and Resilience Across Time

When investing for a single lifetime, the focus is often on maximizing returns within a known time horizon. But when planning across generations, the priorities shift. The goal is no longer just growth—it’s sustainable growth. This means protecting capital as much as expanding it. A portfolio designed to last 50 or 100 years must withstand economic cycles, inflation, geopolitical shifts, and personal upheavals. Chasing high yields may offer short-term excitement, but it often comes at the cost of long-term stability. True intergenerational wealth preservation requires a disciplined approach that balances return with resilience.

One of the most effective tools for achieving this balance is volatility management. High volatility can erode wealth during downturns, especially if withdrawals are needed at inopportune times. For example, if a family must sell depressed assets to cover expenses during a recession, the damage can be irreversible. To mitigate this risk, portfolios should include a mix of lower-volatility assets—such as high-quality bonds, dividend stocks, and real estate—that provide steady income and act as ballast during turbulent markets. At the same time, exposure to equities ensures participation in long-term economic growth. The exact allocation will vary based on family goals, risk tolerance, and time horizon, but the principle remains: stability enables sustainability.

Liquidity planning is equally crucial. While some assets, like private businesses or real estate, may offer strong returns, they are not easily converted to cash. A well-structured portfolio includes a tiered approach to liquidity—short-term reserves in cash or money market funds, medium-term options in bonds or CDs, and long-term growth assets in equities or alternative investments. This structure allows families to meet immediate needs without disrupting long-term strategies. For instance, if a grandchild needs funds for college, the portfolio can draw from liquid reserves rather than selling appreciated stock at a loss.

Another key concept is horizon diversification. Most investors think in terms of a single time frame—retirement in 20 years, say. But multi-generational planning requires multiple horizons: near-term (0–10 years), mid-term (10–30), and long-term (30+). Each layer serves a different purpose. Near-term assets fund current obligations and emergencies. Mid-term holdings support major life events like home purchases or education. Long-term investments focus on compounding growth, benefiting future generations who may not yet be born. By structuring the portfolio this way, families avoid the trap of overextending for today at the expense of tomorrow. Time, in this context, becomes an ally—not a constraint.

Structuring for Transition: From Owner to Steward

Wealth transfer is rarely a single event. It’s a process—one that unfolds over years, even decades. The transition from owner to steward is not automatic; it must be prepared for. Too many families wait until a crisis—illness, death, or conflict—before addressing succession. By then, emotions run high, clarity is low, and mistakes are costly. A better approach is to begin early, with intention and structure. This means not only naming beneficiaries but also preparing them to receive and manage wealth responsibly.

One effective method is phased decision-making. Rather than handing over control all at once, families can gradually increase involvement. For example, a child might start by observing family investment meetings, then progress to voting on minor allocations, and eventually take on leadership roles in a family office or advisory council. This apprenticeship model builds competence and confidence. It also fosters accountability, as younger members learn that wealth comes with responsibility, not just privilege. Educational workshops on budgeting, investing, and philanthropy can further support this development, ensuring that heirs understand not just how to manage money, but why it matters.

Governance frameworks are another essential component. These can range from informal family charters to formal trusts with appointed trustees and advisory boards. What matters most is clarity: Who makes decisions? How are disagreements resolved? What values guide investment choices? A written governance structure reduces ambiguity and prevents power struggles. It also creates space for dialogue, allowing family members to express concerns, share goals, and align expectations. In some cases, an independent fiduciary or financial advisor can serve as a neutral facilitator, helping to maintain objectivity during emotionally charged discussions.

Communication is the foundation of all this. Open, honest conversations about money—its sources, its uses, its responsibilities—help build trust. Families that talk regularly about finances tend to experience fewer conflicts during transitions. These discussions should not be limited to adults; even young children can learn basic financial concepts through age-appropriate conversations. As they grow, so can the depth of the dialogue. The goal is not to burden children with adult worries, but to equip them with understanding. When wealth is demystified, it becomes less threatening and more empowering.

Aligning Assets with Values: Beyond ESG

Environmental, Social, and Governance (ESG) investing has gained popularity as a way to align portfolios with ethical principles. While this framework offers a useful starting point, it often lacks personal depth. For families seeking to embed cultural identity into their investments, ESG may feel too generic. A company might score well on carbon emissions or board diversity, yet have no connection to the family’s history, values, or community. True alignment goes deeper. It means asking not just whether an investment is “responsible,” but whether it is meaningful.

Consider a family with deep roots in a particular region. They might choose to allocate a portion of their portfolio to local small businesses, agricultural cooperatives, or community development projects. These investments do more than generate returns—they strengthen ties to place and people. Similarly, a family that values education might create a dedicated fund for scholarships, or invest in companies developing affordable learning technologies. A family committed to preserving language and tradition might support cultural centers, media initiatives, or heritage tourism ventures. These choices turn abstract values into concrete action.

Exclusion criteria are equally important. Just as some assets are included for their positive impact, others may be excluded because they contradict family principles. This could mean avoiding industries like tobacco, gambling, or weapons, or steering clear of companies with poor labor practices or environmental records. The key is consistency—defining clear guidelines and sticking to them, even when higher returns are tempting. Discipline here reinforces integrity, sending a message to heirs that values matter more than profit alone.

To implement this kind of personalized investing, families can work with advisors who understand both finance and cultural context. Customized portfolios may include direct investments, private equity funds with specific mandates, or donor-advised funds for philanthropy. The process should involve the whole family, with regular reviews to ensure alignment as values evolve. Over time, this approach builds a portfolio that is not only financially sound but emotionally resonant—where every holding tells a story, and every decision reflects a choice.

Avoiding the Common Traps in Legacy Planning

Even the best intentions can go astray without careful planning. Many families fall into predictable traps that undermine both wealth and relationships. One of the most common is overconcentration—placing too much of the portfolio in a single asset, often the family business or a beloved stock. While this may reflect pride or loyalty, it creates significant risk. If that asset declines, the entire portfolio suffers. Diversification is not just a financial principle; it’s a safeguard against emotional attachment clouding judgment.

Another trap is lack of transparency. When investment decisions are made behind closed doors, without involving or informing heirs, resentment can build. Children may feel excluded or distrusted. Siblings may suspect favoritism. These dynamics can erupt during transitions, turning grief into conflict. To prevent this, families should prioritize openness. Regular updates, inclusive meetings, and clear documentation help ensure everyone is on the same page. Transparency doesn’t mean giving up control—it means building trust.

Mismatched expectations are also a frequent source of tension. Parents may assume their children share their values or financial habits, only to discover otherwise. A child raised in abundance may lack experience with budgeting or delayed gratification. Without preparation, sudden wealth can lead to poor decisions—overspending, risky ventures, or family disputes. Proactive education and gradual involvement can bridge this gap, helping heirs develop financial maturity before receiving significant assets.

Finally, many families fail to plan for the unexpected. Life is unpredictable—divorces, disabilities, market crashes, or personal failures can all impact wealth. Relying on a rigid, one-size-fits-all plan leaves little room for adaptation. Instead, families should build flexibility into their structures, using tools like revocable trusts, spendthrift clauses, or staggered distributions. These mechanisms protect assets while allowing for compassionate responses to individual circumstances. Professional guidance—from financial planners, estate attorneys, or family therapists—can help navigate these complexities, ensuring that the plan is both legally sound and emotionally intelligent.

Creating a Framework That Endures

Building a lasting legacy is not about perfection—it’s about process. The most successful families don’t rely on rigid rules or one-time decisions. They create systems that endure because they are thoughtful, adaptable, and inclusive. At the heart of such a system is a clear sense of purpose. What is this wealth for? Who are we as a family? What do we hope to contribute to the world? Answering these questions provides a compass for all financial decisions, ensuring that investments align with deeper goals.

From this foundation, families can design portfolios that are both resilient and meaningful. Diversification protects against risk, while value-aligned investing reinforces identity. Governance structures ensure continuity, and education prepares the next generation. Regular reviews allow for course corrections, keeping the plan relevant across changing times. This is not a set-it-and-forget-it approach; it’s an ongoing practice of stewardship—one that requires attention, dialogue, and humility.

Ultimately, the goal is not just to pass down wealth, but to pass down wisdom. Money alone cannot sustain a family. But when combined with values, communication, and shared purpose, it becomes a powerful force for good. The portfolios we build today will shape the opportunities of tomorrow. They will influence how our children see themselves, how they treat others, and what they believe is possible. In this light, investing is not just a financial act—it’s a moral one. And the legacy we leave will be measured not only in dollars, but in the strength of the family we helped create.