How I Turned My Gym Fees into Steady Gains—Without Lifting a Dumbbell

What if your monthly gym membership could do more than just keep you fit—what if it actually helped grow your money? I used to see my fitness expenses as a fixed cost, until I realized they could be part of a smarter financial strategy. By rethinking how I pay, when I commit, and what I get in return, I turned a routine expense into a tool for stable returns. This isn’t about skipping workouts—it’s about working out your wallet too. Most people treat gym fees as unavoidable, but with the right approach, they can become a lever for financial discipline, predictable savings, and even indirect investment returns. The shift begins not with a change in routine, but in mindset.

The Hidden Cost of Getting Fit

Fitness is widely celebrated for its physical and mental benefits, yet few pause to consider the full financial footprint of staying active. A typical gym membership ranges from $30 to $80 per month, a figure that may seem modest at first glance. But over five years, that same fee accumulates to between $1,800 and $4,800—money that could have been allocated toward emergency savings, debt reduction, or low-risk investments. For many households, especially those managing tight budgets, these recurring charges quietly erode financial flexibility without delivering proportional value.

The issue isn’t the gym itself, but the passive way most people engage with their memberships. They sign up with good intentions, pay automatically each month, and rarely assess whether they’re receiving adequate return on that spending. This lack of scrutiny transforms a well-meaning health decision into a form of financial leakage. Consider a woman paying $50 monthly for a gym she visits only eight times a year—her cost per visit exceeds $75, far more than a single session at a premium fitness studio. In this light, the gym is no longer a bargain, but an inefficient use of funds.

Yet the solution doesn’t lie in quitting fitness altogether. Instead, it involves reframing the gym membership not as a fixed expense, but as a financial instrument with potential for optimization. When viewed through this lens, every decision—from payment timing to service utilization—becomes an opportunity to improve personal financial efficiency. The goal is not austerity, but alignment: ensuring that money spent supports both health goals and long-term financial stability. By recognizing the cumulative impact of small, regular outflows, individuals can begin to treat fitness spending with the same intentionality they apply to utility bills or insurance premiums.

Why Stability Matters More Than Big Wins

In the world of personal finance, the allure of high returns often overshadows the quiet power of consistency. Many people dream of doubling their money through stocks, real estate, or side hustles, yet these paths come with volatility and uncertainty. For the average individual, especially those juggling family responsibilities and fixed incomes, chasing big wins can introduce stress rather than security. A more sustainable path lies in cultivating stable, predictable returns—particularly when tied to essential expenditures like fitness.

Stability in finance means minimizing surprises. It’s the difference between knowing exactly what your obligations are and facing unexpected rate hikes or hidden fees. Gym memberships, when managed strategically, offer a rare opportunity to build financial predictability. Unlike stock markets or rental income, the cost of a gym is fixed and controllable. By optimizing how and when that cost is paid, individuals can generate what amounts to a guaranteed return—through avoided expenses—without exposing themselves to market risk.

Consider two scenarios: one person pays $60 monthly, allowing automatic renewals without review, while another pays annually during a promotional period and uses all included services. Over three years, the first spends $2,160 with inconsistent attendance; the second pays $500 upfront, uses the gym regularly, and accesses free classes and wellness assessments. Though neither earns cash dividends, the second individual achieves a higher effective return on investment through disciplined behavior. This is the essence of stability-based finance: small, repeatable choices that compound over time.

Moreover, stability fosters confidence. When people see that their financial decisions yield consistent results, they are more likely to extend that discipline to other areas—budgeting, saving, and even long-term planning. The gym, in this context, becomes more than a place to exercise; it becomes a training ground for financial resilience. The lesson is clear: reliable gains, though less flashy, provide a stronger foundation for lasting wealth than sporadic windfalls.

The Prepayment Power Move

One of the most effective—and underused—strategies in personal finance is prepayment. Paying for a full year of gym access upfront may seem counterintuitive, especially when cash flow is tight. But when analyzed closely, annual payments often come with discounts of 20% to 40% compared to monthly plans. This immediate reduction in total cost functions like a risk-free return on capital. For example, paying $600 annually instead of $60 per month saves $120 in the first year alone—a 20% gain on the initial outlay, realized simply by changing the payment structure.

Beyond the discount, prepayment offers additional financial benefits. It locks in the current rate, protecting against future price increases. Gyms frequently raise membership fees, sometimes by as much as 10% annually. By paying in advance, individuals insulate themselves from inflationary pressures within the fitness industry. This is particularly valuable for those on fixed incomes who rely on predictable expenses. Prepayment transforms a recurring obligation into a one-time decision, reducing both financial and cognitive load.

Some may worry about the liquidity cost of paying a large sum upfront. However, for those who already budget for the expense, shifting from monthly to annual payments doesn’t increase total spending—it merely changes the timing. In fact, the savings generated can be reinvested elsewhere, such as into a high-yield savings account or debt repayment. The psychological benefit is equally important: once the payment is made, there’s greater motivation to use the gym regularly, turning the membership into a value-generating asset rather than a sunk cost.

Viewed through a financial lens, prepayment resembles a micro-investment. It requires a small upfront commitment and delivers guaranteed returns in the form of avoided future spending. Unlike speculative ventures, there’s no risk of loss—only the opportunity cost of not using the funds elsewhere. For cautious investors, this makes prepayment one of the safest financial moves available. By adopting this strategy, individuals turn a routine bill into a deliberate act of financial empowerment.

Leveraging Bundled Services for Extra Value

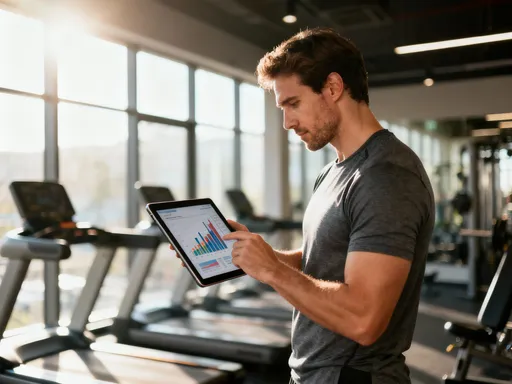

Most gym memberships include far more than access to cardio machines and weight rooms. Facilities often offer group fitness classes, personal training consultations, wellness workshops, towel service, and even partnerships with nutrition programs or recovery centers. Yet studies suggest that over 60% of members use fewer than half of the services included in their plans. This underutilization represents a significant financial inefficiency—like paying for a premium subscription and only using basic features.

Maximizing value begins with awareness. Members should conduct a thorough audit of what their fees cover. A $70 monthly plan that includes unlimited yoga, Pilates, and access to a physical therapy assessment is fundamentally different from one that offers only equipment access. By identifying unused benefits, individuals can either begin using them—increasing the return on their spending—or negotiate upgrades at no extra cost. For instance, someone paying for a basic plan might request a trial of the premium tier during a promotional window, effectively testing higher value without additional expense.

Another strategy involves leveraging partnerships. Many gyms collaborate with local businesses, offering discounts on healthy meals, massage therapy, or athletic gear. These perks, though seemingly minor, contribute to overall financial efficiency. A 15% discount on a $100 pair of running shoes may appear small, but when combined with other benefits, such savings accumulate. Over time, these passive gains offset a portion of the membership cost, improving the net financial outcome.

For families, the potential for value extraction increases further. Some memberships allow spouse or child add-ons at reduced rates, or even free access during certain hours. By coordinating usage across household members, families can spread the cost while increasing utilization. This approach mirrors portfolio diversification—spreading investment across multiple assets to improve overall return. In the case of gym memberships, the “assets” are services and access points, and the return is measured in both health outcomes and financial efficiency.

Timing Commitments Like a Pro

Just as investors wait for favorable market conditions before buying assets, savvy consumers know that timing matters when signing up for recurring services. Gym pricing is not static; it follows seasonal cycles influenced by New Year resolutions, back-to-school periods, and corporate enrollment windows. The beginning of the year, for example, often brings promotional offers designed to attract new members. These deals may include waived initiation fees, discounted first months, or extended free trials.

However, the smartest move is not always to sign up immediately. Many gyms offer better terms to those who convert from a trial membership, especially if they wait until the final days of the trial period. Sales representatives, under pressure to meet conversion targets, are more likely to offer concessions such as price matching, added services, or extended billing cycles. By delaying the decision, individuals gain negotiating power and increase their chances of securing a better deal.

Corporate partnerships also create opportunities. Employers sometimes subsidize gym memberships or offer them through wellness programs at reduced rates. These arrangements often provide access to multiple locations and additional benefits, all at a fraction of retail cost. Employees should review their benefits package annually and enroll during open enrollment periods to maximize savings. Similarly, alumni associations, credit unions, and professional organizations may offer discounted access through group purchasing agreements.

Another overlooked timing strategy involves renewal dates. Rather than allowing automatic renewal at the standard rate, members can initiate cancellation and wait for the gym to counter with a retention offer. These offers frequently include temporary discounts or bonus services designed to keep customers. By treating the renewal process as a negotiation rather than a formality, individuals can reduce long-term costs without sacrificing access. This disciplined approach mirrors value investing—waiting for the right price before committing capital.

Tracking and Measuring Your Fitness ROI

Financial progress depends on measurement. Just as investors monitor portfolio performance, individuals should assess the return on their fitness spending. Without tracking, it’s impossible to know whether a gym membership is delivering value. A simple framework can help: calculate the cost per visit by dividing the total annual fee by the number of times the gym was used. A $720 annual membership used 36 times yields a cost of $20 per visit—reasonable for full access. But if used only 12 times, the cost jumps to $60 per visit, raising questions about continued enrollment.

Beyond cost per visit, consider non-financial returns. Improved energy, better sleep, reduced stress, and increased focus are all measurable benefits that contribute to quality of life and productivity. While harder to quantify, these outcomes have real economic value. For example, someone who feels more alert at work may complete tasks faster or avoid costly health issues down the line. Tracking mood, energy levels, and attendance can help connect financial input to personal output.

Regular review cycles—quarterly or semi-annually—are essential. At each interval, evaluate usage patterns, satisfaction levels, and alternative options. This process mirrors an investment portfolio review: underperforming assets are sold, and capital is reallocated to higher-return opportunities. A gym that no longer fits lifestyle needs can be replaced with a more convenient location, a different type of fitness program, or even a pause in membership during low-usage periods.

Technology can aid this process. Mobile apps and wearable devices often sync with gym check-ins, providing accurate attendance data. Spreadsheets can track spending, usage, and perceived benefits over time. By introducing accountability, individuals prevent emotional spending—renewing out of habit rather than value. The goal is not perfection, but progress: ensuring that every dollar spent supports both physical well-being and financial health.

Building a Habit That Pays You Back

The most powerful financial strategies are those that align with behavior. When fitness and financial discipline reinforce each other, a positive feedback loop emerges. Showing up at the gym increases the value extracted from each dollar paid, which in turn justifies the expense and encourages continued commitment. Over time, this cycle strengthens both physical resilience and financial responsibility. The individual isn’t just maintaining health—they’re practicing consistency, delayed gratification, and intentional spending.

This alignment doesn’t require dramatic changes. It begins with small, repeatable choices: choosing annual over monthly billing, using included classes, negotiating at renewal, and reviewing usage regularly. Each action builds confidence and competence. As people see the tangible results of their decisions—lower costs, higher utilization, improved well-being—they become more engaged in managing other areas of their finances.

Ultimately, the story of turning gym fees into gains is not about money alone. It’s about mindset. It’s recognizing that every expense carries potential for optimization, and that personal finance is not separate from daily life, but woven into it. By treating necessary spending as an opportunity rather than a burden, individuals gain control, reduce waste, and create space for meaningful growth. The gym becomes more than a place to build muscle—it becomes a symbol of disciplined living, where effort compounds quietly, steadily, and reliably.