Love, Money, and Smart Moves: Navigating Remarriage Without Financial Pitfalls

Remarrying brings joy, new beginnings, and deeper connections—but it also comes with hidden financial risks many overlook. I learned this the hard way. Merging lives means merging money, and without clear planning, emotions can cloud judgment. From blended families to shared assets, the stakes are high. This is not just about love; it’s about protection, clarity, and smart choices that safeguard your future. While romance inspires hope, lasting security comes from thoughtful preparation. Understanding how finances shift in remarriage empowers individuals to protect what they’ve built while embracing what lies ahead. The goal is not to approach love with suspicion, but to honor it with responsibility.

The Emotional Blind Spot in Financial Decisions

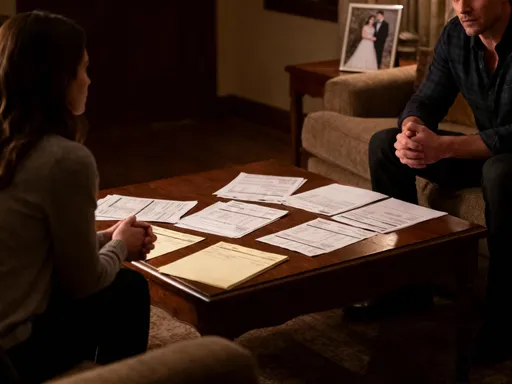

When love returns after loss or divorce, it often arrives with a sense of renewal and urgency. Many entering remarriage feel eager to blend lives quickly, assuming that mutual affection eliminates the need for formal financial discussions. Yet this emotional momentum can become a liability. Decisions made in the warmth of connection—such as combining bank accounts, co-signing mortgages, or gifting assets—can carry long-term consequences if not grounded in transparency and planning. Trust is vital, but it should be supported by structure. Without it, one partner may unknowingly assume financial burdens or lose control over personal savings accumulated over years.

Consider the case of a woman in her early 50s who remarried after being widowed. Within months, she added her new husband to her primary checking account, believing it symbolized unity. However, he began using the funds to pay off old debts she knew nothing about. By the time she realized the extent of the withdrawals, nearly $40,000 had been spent—money she had set aside for medical expenses and travel. There was no legal barrier because the account was now jointly held. This scenario illustrates how easily emotional generosity can blur financial boundaries. The absence of prior discussion created a situation where love was exploited, not intentionally, but through lack of clarity.

Such stories are not rare. Financial advisors frequently report that couples in second or subsequent marriages skip essential conversations about income, spending habits, and debt because they fear conflict or believe love should transcend money. But avoiding these topics does not protect the relationship—it increases vulnerability. Emotions can distort perception, making risks seem smaller and trust seem sufficient. In reality, financial alignment requires deliberate effort. It begins with acknowledging that remarriage is both an emotional and legal union, and that money plays a role in sustaining both. Open dialogue, even when uncomfortable, builds resilience. Setting expectations early—about contributions, responsibilities, and individual rights—creates a foundation where love can thrive without financial strain.

Blended Families, Complicated Finances

One of the most intricate challenges in remarriage is managing the financial needs of a blended family. Unlike first marriages, where financial responsibilities typically begin together, remarried couples often enter the union with existing obligations—to children, ex-spouses, or aging parents. These commitments don’t disappear with a new marriage; instead, they now coexist with new goals like saving for a shared home or planning for joint retirement. Without careful coordination, these dual priorities can create tension, resentment, and even legal disputes.

Imagine a man who remarries and has two adult children from his first marriage. His new wife has a teenage daughter still in high school. He continues to support his children through graduate school while also helping fund his stepdaughter’s college education. Over time, his retirement savings stagnate, and disagreements arise over how much each child should receive. His wife feels he favors his biological children, while he believes he has a moral duty to support them. These feelings are common and understandable. Yet without predefined guidelines, such situations can erode trust and create perceptions of unfairness—even when both partners act with good intentions.

The complexity grows when inheritance is involved. Parents naturally want to leave something for their children, but in a blended family, unequal distributions can lead to conflict after death. For example, if a spouse leaves all assets to the surviving partner without provisions for their own children, those children may feel disinherited. Conversely, if assets are divided strictly by bloodline, the surviving spouse could face financial hardship. These outcomes are preventable with thoughtful planning. Establishing separate trusts for children, defining education funding limits, or using life insurance policies to balance legacies can provide equitable solutions. The key is addressing these issues proactively, not reactively.

Equally important is transparency with children. While parents are not obligated to disclose every financial detail, open communication helps manage expectations and reduce misunderstandings. A simple conversation about intentions—such as “I plan to support your education, but I also need to protect my retirement”—can go a long way in fostering acceptance. Ultimately, financial fairness in blended families is not about equal dollar amounts, but about clarity, consistency, and respect for all members. When each person feels seen and valued, the family unit becomes stronger, not strained, by financial decisions.

Asset Protection: Why "Mine, Yours, and Ours" Matters

Merging finances in remarriage often begins with the romantic idea of “everything we have is ours together.” While this sentiment reflects commitment, applying it universally to assets can lead to unintended consequences. Property, investments, retirement accounts, and even family heirlooms carry personal, legal, and financial significance. Treating all assets as jointly owned without distinction risks diluting individual legacies and exposing pre-marital wealth to potential loss in the event of divorce or death.

Take the example of a woman who owned a home outright before remarrying. After the wedding, she added her husband’s name to the deed, intending to share her life and property. Years later, after a difficult separation, she discovered that selling the house required his consent—and that he could claim half its appreciated value, despite contributing nothing to the original purchase. Because the title was changed, the home was legally considered marital property. This outcome was not malicious, but it was avoidable. By retaining sole ownership or using a cohabitation agreement, she could have preserved her asset while still welcoming her husband into her home.

This is where legal tools like prenuptial and postnuptial agreements become valuable. Far from being signs of distrust, these documents serve as practical frameworks for defining what remains separate and what becomes shared. They allow couples to honor both individual histories and joint futures. A prenup can specify that retirement funds accrued before marriage remain the sole property of the original owner, or that an inheritance received during the marriage stays outside the marital estate. Such agreements do not undermine love—they protect it by removing ambiguity during emotionally charged times.

Titling assets correctly is equally crucial. Bank accounts, real estate, and investment portfolios should be reviewed before and after marriage to ensure ownership aligns with intentions. Joint tenancy with rights of survivorship automatically transfers ownership upon death, which may or may not reflect a person’s wishes. Payable-on-death designations and beneficiary forms often override wills, making them powerful yet frequently overlooked tools. By understanding how different forms of ownership function, individuals can make informed choices that balance generosity with prudence. The goal is not to build walls, but to create a financial structure where both partners feel secure and respected.

Debt Isn’t Just Personal—It Becomes Shared

Many people assume that debt remains the sole responsibility of the person who incurred it. In reality, marriage can transform individual liabilities into shared obligations, depending on jurisdiction and financial behavior. In community property states, for example, debts acquired during the marriage are typically considered joint, even if only one spouse signed the loan. But even in non-community states, co-signing, joint accounts, or shared expenses can link financial fates in ways that are not immediately obvious.

Consider a woman who remarried a man with significant credit card debt from a previous relationship. Though she did not use the cards, she agreed to open a joint account to “start fresh.” Within months, creditors began pursuing her for payments when her husband fell behind. Because the account was jointly held, she was legally liable for the full balance. Her credit score dropped, and she was denied a car loan she needed for work. This scenario highlights how easily one partner’s financial past can impact the other’s present and future. Even well-intentioned efforts to help can backfire without safeguards.

Credit history also plays a critical role. When applying for loans together—such as a mortgage—lenders evaluate both credit scores. A low score on one side can result in higher interest rates or outright denial, affecting major life plans. For instance, a couple might qualify for a 6.5% mortgage rate instead of 5.2% due to one partner’s poor credit, costing thousands in additional interest over the life of the loan. These financial penalties are not theoretical—they are real, measurable, and avoidable with proper planning.

The solution begins with full financial disclosure before marriage. Both partners should exchange detailed information about income, debts, credit scores, and financial obligations. This is not an invasion of privacy, but a necessary step toward transparency. If one partner has substantial debt, they can create a repayment plan with professional guidance. Alternatively, maintaining separate accounts and credit lines can limit exposure while still allowing for shared household expenses. The key is awareness: knowing what you’re stepping into allows you to make informed choices. Love should not require financial blindness—it should be accompanied by mutual understanding and shared responsibility.

Retirement Plans at Risk Without Coordination

Retirement savings represent decades of disciplined planning and sacrifice. In remarriage, these hard-earned funds can be unintentionally compromised if beneficiary designations and legal rights are not updated. Unlike other assets, retirement accounts such as 401(k)s and IRAs are governed by strict rules that often override wills. If a person dies without updating their beneficiary form, the account goes to the named individual—even if the will states otherwise. This creates a common but preventable risk in blended families.

Imagine a man who built a substantial 401(k) during his first marriage. After his wife passed, he failed to change the beneficiary designation. When he remarried and later died, the account went to his deceased ex-wife’s estate, not his new spouse or stepchildren. Despite his verbal intentions, the legal document controlled the outcome. This is not an isolated case. Financial institutions follow paperwork, not promises. Without regular reviews, even the most thoughtful plans can fail.

Marriage also affects pension benefits and Social Security. Some pension plans automatically provide survivor benefits to a new spouse unless waived in writing. While this protects the surviving partner, it may reduce the amount available to children from a prior marriage. Similarly, remarriage can affect eligibility for ex-spousal Social Security benefits. A woman who collected benefits based on her first husband’s work record may lose that income if she remarries before age 60. After 60, she may retain it, but the rules are complex and vary by circumstance. Understanding these nuances is essential for accurate planning.

To avoid unintended outcomes, couples should schedule a financial review shortly after marriage. This includes updating beneficiaries on all accounts—retirement, life insurance, and payable-on-death bank accounts. It also means discussing long-term goals: Will both partners retire at the same time? How will healthcare costs be managed? What level of income is needed to maintain lifestyle? These conversations ensure that retirement planning reflects current realities, not outdated assumptions. By aligning documents with intentions, individuals protect both their autonomy and their commitment to their new spouse.

Estate Planning: More Than Just a Will

A will is often seen as the cornerstone of estate planning, but in remarriage, it is only the beginning. Without additional tools, a will alone cannot address the complexities of blended families, incapacity, or asset distribution. Comprehensive estate planning includes trusts, powers of attorney, healthcare directives, and guardianship designations—all of which work together to ensure that a person’s wishes are honored, even in difficult circumstances.

For example, a revocable living trust allows individuals to specify exactly how and when assets are distributed. This is particularly useful when leaving inheritances for children from a prior marriage. Instead of transferring everything to the surviving spouse, the trust can stipulate that remaining assets pass to the children after the spouse’s death. This prevents accidental disinheritance while still providing for the current partner. Trusts also avoid probate, reducing delays and legal costs for heirs.

Power of attorney is another critical component. It designates someone to manage financial and medical decisions if a person becomes incapacitated. In remarriage, this raises sensitive questions: Should the new spouse have full authority, or should adult children from a prior marriage be involved? These decisions require honest discussion. Without clear instructions, family members may disagree, leading to court intervention and emotional distress. A durable power of attorney, combined with a healthcare directive, ensures that trusted individuals can act in alignment with the person’s values.

Guardianship planning is equally important for couples with minor children. If a parent dies, the surviving spouse typically becomes guardian. But what if both parents pass away? Naming a guardian in a will prevents the court from making that decision. For blended families, this may involve choosing between biological relatives, stepparents, or other trusted individuals. While difficult, this conversation is necessary to protect children’s stability. Estate planning is not about anticipating death—it’s about preserving dignity, peace, and family harmony during life’s most vulnerable moments.

Smart Moves That Keep Love and Finances in Balance

Building a successful remarriage requires more than emotional compatibility—it demands financial wisdom. The most resilient relationships are those where love and practicality coexist. This balance is achieved not through suspicion, but through intentional action. Regular financial check-ins, open communication, and professional guidance form the foundation of a secure future. These practices do not diminish trust; they strengthen it by reducing uncertainty and preventing misunderstandings.

One effective strategy is to establish a “financial date” once a month. During this time, couples review budgets, track progress toward goals, and discuss any concerns. These conversations normalize money talk and prevent small issues from becoming major conflicts. For blended families, including children in age-appropriate discussions—such as saving for college or setting spending limits—can promote financial literacy and reduce tension. Transparency builds trust, especially when everyone understands the bigger picture.

Hiring a neutral financial advisor or estate planner can also provide objective support. These professionals help couples navigate complex decisions without emotional bias. They can facilitate conversations about prenups, trusts, or retirement planning in a structured, respectful way. Their role is not to take sides, but to ensure both partners feel heard and protected. For those concerned about cost, many advisors offer flat-fee consultations or limited-scope services tailored to specific needs.

Finally, it’s important to remember that planning is an ongoing process. Life changes—jobs, health, family dynamics—and financial strategies must evolve too. Revisiting agreements every few years, especially after major events like a child’s graduation or a parent’s passing, ensures that plans remain relevant. The goal is not perfection, but preparedness. By treating financial planning as an act of care, couples affirm their commitment to each other and to the future they are building together. Love may bring two people together, but clarity, responsibility, and mutual respect are what keep them united for the long journey ahead.